RET cuts will slash green investment, destabilise grid, lift prices

A new report has found that the winding back or scrapping of Australia’s Renewable Energy Target would set new-build energy generation back by 10 years, cost billions in lost renewables investments, drive up power prices and destabilise the grid.

Published by Intelligent Energy Systems Advisory Services (IES), the report also warns that changes to the RET could increase coal-fired generation by as much as 9 per cent, jeopardising Australia’s ability to meet its 5 per cent by 2020 greenhouse gas emissions reduction target under the Kyoto Protocol.

The IES study uses electricity market modelling to assess the impact on Australia’s National Electricity Market if the current 41,000 GWh renewable energy target is cut to a “real” 20 per cent (as some incumbent generators want), or scrapped entirely from 2015 (as others want) – two of the more commonly predicted outcomes of the Abbott government’s current RET review.

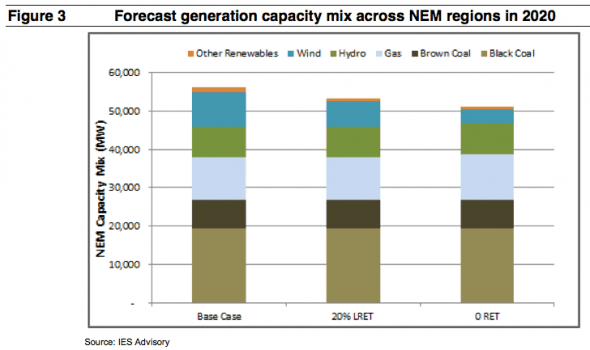

“Under a reduced LRET, investments in electricity generation will fall dramatically,” says the report, with around 5,080MW less capacity expected to be built under the zero RET scenario, and 2,940MW less under the 20 per cent LRET scenario. The main victim will be wind generation.

“Wind project development will reduce by 2,280MW under the 20 per cent LRET scenario, and by 5,100MW under the zero RET scenario, resulting in the loss of investment opportunity of $4.5 billion and over $10 billion respectively.”

Even with the support of the LRET, the report notes wind developers are struggling to develop economically viable wind projects, with PPA (power purchase agreement) prices of below $90 per MWh offered by gentailers.

Under a revised or scrapped RET scenario, and with the likely repeal of carbon tax, the picture looks bleak, with worsening project economics and difficulty in obtaining debt finance predicted to cause the stalling or cancellation of more than 2900MW of planned large-scale wind and other renewables projects.

As you can see in the chart below, under the zero RET scenario, wind and other renewable generation falls by more than 50 per cent compared to the base case.

As for solar, IES says around 223MW of large-scale solar PV or thermal solar developments were modelled in its study. “However, at LCOE of over $150/MWh these projects would not be economically viable without substantial government subsidies in place, even under the base case scenario.”

Coal-fired power plants, meanwhile, would move up in the generation merit order, with black coal and brown coal generation predicted to increase by 9 per cent under the zero RET scenario and by 5.6 per cent under the 20 per cent LRET scenario compared to the base case scenario.

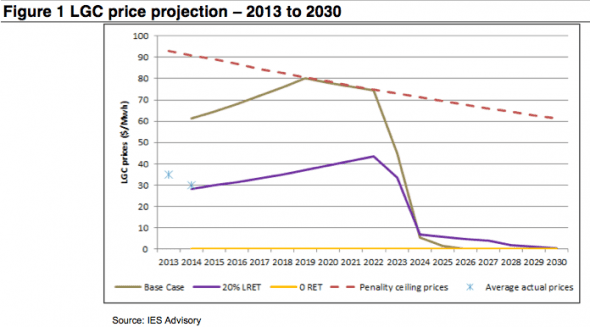

The boost to coal would be largely due to rising gas prices, the removal of carbon prices and decreased LGC prices, which the IES estimates would be halved under the 20 per cent LRET scenario, falling 55 per cent lower than prices under the base case till 2024 – an effect IES says “will negatively impact the profitability and investment decisions of large-scale renewable projects.”

The report also warns that a relatively low level of generation capacity investments could restrain economic growth and lower the level of services to consumers.

“Potential under-investment in generation capacity in the NEM can create many challenges to network operators with increased network constraints and higher frequency of blackouts, and to independent retailers, industrials and consumers, inducing wholesale price volatility, difficulties in hedging and risk management, and weaker market competition,” says IES.

Notably, it says, electricity prices under the zero RET scenario would be higher than prices under the 20% LRET scenario, with the reduction in renewable generation pushing up electricity pool prices.

“This will at least partially counteract cost savings effected from scrapping the RET,” says the report.

In conclusion, says the IES, “a halt to the LRET may not clearly outweigh the benefits of a well-set long term large-scale renewable energy target, nor will it result in the lowest electricity prices due to restrained investments in generation capacity.”

The findings of the IES report will fan the fears of many in the renewable energy industry, who have long argued that the Renewable Energy Target is crucial to the health of the burgeoning and potentially lucrative sector.

“If the review recommends a cut to the RET, it’ll be clear they’re looking after their fossil-fueled friends, not the interests of Australians,” said Leigh Ewbank, renewables spokesperson for Friends of the Earth, on Tuesday.

Ewbank argues that, as well as driving up coal use and emissions, the dilution or scrapping of the RET would also cost Australia jobs.

S