An analysis of global energy prices and production released by Gail Tverberg of Our Finite World last week indicates that the Peak Oil crisis of 2007 has now translated into Peak Debt depriving governments of revenue and leading to high disatisfaction levels with governments.

Her analysis shows that a number of factors have led to a short term energy glut and decrease in raw energy prices. They include: the production of non-conventional fuels, such as Coal Seam Gas, the release of Iraq’s vast oil supplies subsequent to the US invasion and subsidies for renewable energy

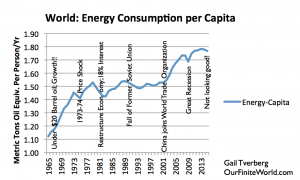

Regardless, domestic energy prices have risen, energy consumption per capita across the globe has plateaued and the debt per capita increased to the point where governments can no longer afford to provide traditional services, thereby leading to popular unrest.

She predicts a global economic collapse significantly larger than the global financial crisis of 2008 or the Great Depression of the 1930s.

http://www.countercurrents.org/2016/08/09/an-updated-version-of-the-peak-oil-story/