Insurance premiums are predicted to double due to climate change.

By Cameron Jewell

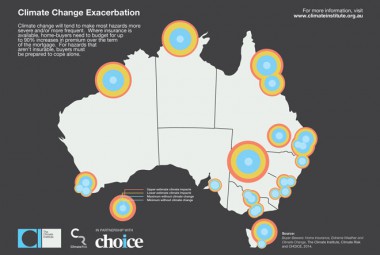

5 June 2014 — Climate change-fuelled extreme weather events could lead to a doubling in insurance premiums and reduce home values by more than 20 per cent, new research from The Climate Institute and consumer group CHOICE has revealed.

The report, Buyers Beware: Home Insurance, Extreme Weather and Climate Change, found that some areas, like the cyclone prone north of Australia and even parts of major cities, already had premiums up to 10 times that of lower risk areas.

And if the high end of climate change predictions turns out to be true – and there’s evidence suggesting we’re tracking along this path – insurance premiums could rise by an average 92 per cent by 2050, with the impact of insurability reducing home values by 20 per cent or more over the life of a standard 30-year mortgage.

- A checklist for home buyers to gauge risk is provided below

A growing threat

Home insurability is quickly becoming a large problem for Australia. With extreme weather events from floods, bushfires, severe storms, cyclones, erosion, drought and seawater inundation increasingly affecting the security of homes, insurers have little choice but to raise premiums to cover the higher probability of paying out for losses, insurers say.

On top of this many Australians are living in locations with high natural amenity, with high prices paid for homes along the coast, near rivers and backing on to, or within, bushland. Analysis by Risk Frontiers, for example, estimates there are 150,000 Australian addresses exposed to over ground flooding in a 1-in-100 year event.

Some insurers are already refusing to offer insurance in these high-risk areas, and the report notes that both the affordability and availability of insurance is likely to decrease in response to increased climate and weather risks, which have been predicted by the CSIRO and Bureau of Meteorology.

Australia is an expensive place to insure

Already Australia accounts for a disproportionate amount of insured losses globally. While the country only accounts for two per cent of the global reinsurance market, it accounted for six per cent of global losses last year, according to data obtained from the Insurance Council of Australia.

“This report warns homebuyers that they need to consider extreme weather risk and climate change very seriously,” Climate Institute chief executive John Connor said.

“In high-risk locations, some home insurance policies are already unaffordable and there are insurers who won’t even offer policies at all.

“This report finds that climate and extreme weather impacts add to Australians’ cost of living, with homeowners and buyers often unwittingly caught between failures by government and the marketplace to reveal information about the current risks and how they are projected to worsen.”

- See our article Insurance industry turns to resilience

Insurance affordability crisis

Insurance affordability crisis

CHOICE chief executive Alan Kirkland said that homeowners who unknowingly bought in high-risk areas could find themselves subjected to unaffordable insurance rates. Those currently in high-risk areas were feeling the pain too.

“If you already own in a high-risk area, you need to be careful about the risks of underinsurance – otherwise you may find that your insurance payout is not enough to allow you to rebuild after a major event.”

In fact, underinsured homes in high-risk could receive as little as half of what it would cost to build a new home resilient to local weather extremes and climate change.

Insurance industry gets it, but investors and governments need to catch up

While superannuation funds, some institutional investors and governments put their head in the sand regarding climate risk, the insurance industry is using its high-level risk analysis to price in climate risk – and because the risk is very real that translates into higher premiums.

The whole community ends up paying

But it is taxpayers who invariably end up footing the bill for extreme weather events and uninsured losses. The report noted that after the Queensland floods in 2011, Queensland taxpayers were levied an estimated $1.8 billion to help make up the $5.8 billion needed for relief and reconstruction.

“The rising cost of insurance isn’t a problem just for homeowners and buyers, but rather it lumbers the whole community with a bigger financial burden, with governments often seen as the insurer-of-last-resort,” Mr Connor said. “Ultimately, it’s taxpayers – everyday Australians – who foot the bill when big, costly market failures like this are ignored.”

Governments are doing little to help. A report released in March from the Intergovernmental Panel on Climate Change found that the lessons of past extreme weather events had not been learnt, exposing homeowners and homebuyers to risk.

“Australia is a land of floods and fire, but this hasn’t prevented all tiers of government from allowing the development of many, many vulnerable homes in locations known to be at risk from floods, bushfires, severe storms, erosion, drought and seawater inundation,” Mr Connor said. “And unwitting homebuyers become the ultimate victim of this negligence.”

The report noted that some governments did not require risk disclosure to buyers, and some laws made impeded the availability of risk information.

“Recent legal changes in some states actually make it hard for local government to either protect buyers or inform them of emerging risks revealed by hazard modelling. A recent paper by legal firm DLA-Piper even suggests that the situation is going backward. Under a proposal in New South Wales, for example, councils without a policy on future hazards may not be permitted to include risk warnings in mandatory disclosure on 149(2) certificates, used during house conveyancing. Instead these warnings would be provided in advisory notices available upon request in 149(5) certificates. This type of change may help protect present property owners from having projected risks revealed at the point of sale, but it does so at the expense of new buyers.”

The report called for governments to mandate the disclosure of all available hazard mapping, require that all dwellings and associated infrastructure be built or renovated as fit-for-purpose for the maximum projected impacts over their design life, disclose current and projected insurance premiums for a property at the point of sale, and disclose settlements where climate change risks would make future habitation untenable this century.

Checklist

There was some good news to come out of the report, the authors said. Potential property buyers could use insurability to gauge extreme weather risk and gain insight into whether climate change may exacerbate these risks.

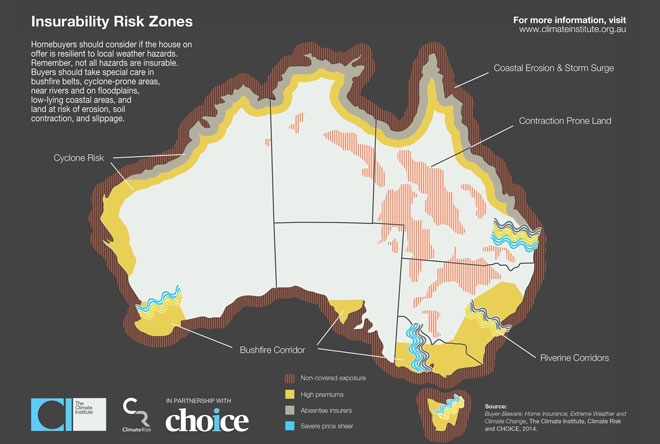

The report listed five insurability risk factors to watch out for:

- Underinsurance – the insurance premium is inadequate to cover the cost of replacing the house to an equivalent level of amenity

- Heightened premiums – the insurance premium of a property is significantly higher than for equivalent properties in other locations

- Absentee insurers – one or more insurers refuse to provide standard online quotes for the property, location or region

- Price sheer – the ratio of the highest quote to the lowest quote; a high ratio indicates an abnormal variation in premiums between insurers for the same level of cover

- Non-covered exposure – a property that is exposed to hazards that are not covered by the insurance policies offered

It also recommended potential homebuyers take into account the following:

- ask local council whether the dwelling is in a location in which historic climate data puts it at risk from extreme weather impacts

- check whether the dwelling will be exposed to rising extreme weather risk because of climate change

- test the house against the five insurability risk indicators mentioned above

- factor into the home purchase price the costs of adaptation, and current and future insurance price increases

- avoid properties where insurance is uncertain, may become unaffordable or unavailable, or will lead to deterioration in property value

The report was put together by Climate Risk, independent climate change adaptation analysts who last year developed a software platform to revalue property and infrastructure assets based on climate risk exposure.

- See our article New Australian software revalues assets based on climate risk

Read the full report.

6 June, 2014