10-year-old explains super tax reform in less than 2 mins

|

Inbox

|

x |

|

6:17 PM (35 minutes ago)

|

|

|||

Dear NEVILLE,

We need a fresh perspective in approaching tax reform.

Nowhere in the near 200 pages of the Government’s ‘Re:think’ tax discussion paper, or in its 60 odd discussion questions, is the most fundamental of questions raised: what kind of society do we aspire to nurture in Australia, and how might tax reform best contribute to establishing such a society?

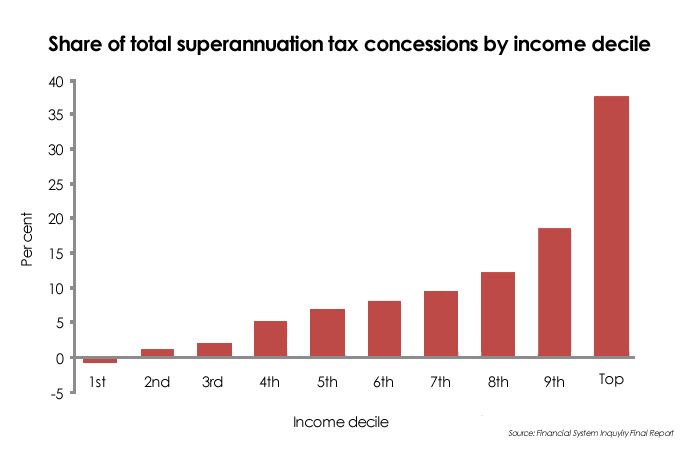

The present tax breaks for superannuation ignore this question entirely. They are very expensive and poorly targeted. Treasury put the costs of these concessions at $32 billion in 2011-2012.1 And the Australian Council of Social Services has stated that half of these concessions go to the wealthiest 20 per cent of Australians.2

Timing is critical for all reforms and momentum for tax reform is now building. Just yesterday, the Labor party announced a super tax reform policy that would go some way to addressing the inequity of the current system. Even so, sustained public pressure will be required to break through the vested interests defending these unfair concessions.

A key part of building that pressure is providing Australians with a fresh perspective on tax reform, in a clear and convincing manner.

Then join us in the campaign to make the super of the future FAIR.

Like most past reviews, the Government’s ‘Re:think’ tax discussion paper focuses on possible ‘reforms’ (often code for ‘reductions’ in personal and company taxes) to promote economic growth.

The need for a strong, competitive economy is a given. The ultimate goal of policy making, however, is not to maximise the growth in GDP but to nurture a prosperous society which is also fair and compassionate. A society with opportunities for all Australians to access decent standards of education, health and other services, and with safety nets for those who – for whatever reasons – fall through the cracks.

This is the kind of society promised profusely by all major parties in every election campaign, only to be rolled back by ideologies and lobby groups when they assume government. That is why it is important to build on the growing momentum for reform.

In regards to super tax reform, this video is part of the fresh perspective we need when starting out to build a better tax system and a better country. I encourage you to watch it and share it with those you know, to make the case for fairer superannuation: https://www.getup.org.au/supertax

Kind regards,

Bernie Fraser

PS – This graph shows just how skewed super tax breaks are towards the wealthy (those in the highest income deciles).

REFERENCES:

[1] ‘Distributional Analysis of Superannuation Taxation Concessions’, Treasury, 2011-2012

[2] ‘ACOSS calls on Government to tackle sacred cow of super tax breaks’, ACOSS, 2014

Graph: ABC Fact Check (Source: Financial System Inquiry Final Report)