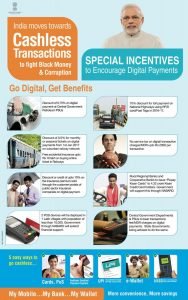

India’s rapid move to a cashless society was part of Prime Minister Morodi’s campaign against corruption and tax avoidance but the consequences of the sudden cancellation of all 500 and 1,000 rupee bills has led to an economic crisis and widespread accusations that it is an attack on the poor. With uneven access to digital and financial services the enforced move to a digital economy is leaving hundreds of millions of people behind. 17% of Indians own a smart phone and only 11% have a credit or debit card. Hundreds of thousands of people have marched in the streets, locking down banks and government offices.

Chakravorti, who co-authored a report titled “The Cost of Cash in India,” found that, “most Indians lack the means to use cashless alternatives irrespective of their desire to do so.”

“The digital infrastructure in India is so horrendously poor,” Chakravorti says. “The majority of people don’t have access to smartphones. Large numbers of them cannot read or write. Mobile connections are extremely poor. Even the people in the city, for them connections are terrible.”

Chakrovorti says policy-makers pushing a cashless society are “essentially putting the cart before the horse. The country needs to invest in its digital infrastructure before it pushes people to digital payments.”

The point of this new act being that no longer will it be necessary to offer payment to employees in cash. It will be possible to pay via cheque, or electronic transfer into a bank account. The aim is, of course, all rather tied in with the demonetisation campaign and the move toward a cashless society. If wages are being paid in a manner easy to check then the tax system can be expected to benefit. And given that vast swathes of India’s economy are entirely informal it’s obviously in the government’s interest for this to happen.

In a further push to cashless economy, the Central cabinet has approved the ordinance for paying wages via electronic means — which means that the government has given its nod for cashless salary. Accordingly, the government approved to amend Section 6 of the Payment Of Wages Act.

http://www.forbes.com/sites/timworstall/2016/12/21/india-repeals-the-truck-acts-in-move-to-cashless-society/#722161f36413

It was a move that could have brought India’s economy to a shuddering halt. Indeed, the seemingly endless queues outside banks, and the difficulty of spending cash at shops and stalls may have seemed like it did. But the decision to demonetise the 500 and 1,000 rupee notes was just one in a series of moves that will push India towards a digital economy.

http://theconversation.com/india-taking-a-step-on-the-road-to-cashless-economy-70309