The trillion-dollar hole in Abbott’s climate policy logic

A new report from global investment giant Citigroup has blown a great big hole in the Abbott government’s logic for aiming low on emissions reduction and renewable energy growth.

The Coalition’s justification for its low-ball climate targets has been, consistently, relentlessly, that it was the economically responsible policy path for the government to take. On the other hand, it argues, the costs of Labor’s “ideological obsession” – a proposed 50 per cent renewable energy target by 2030, and more ambition on emissions reduction – would be “simply catastrophic.”

Unfortunately for Tony Abbott and his environment minister Greg Hunt, the report published by Citi on Tuesday suggests this line of logic is deeply flawed.

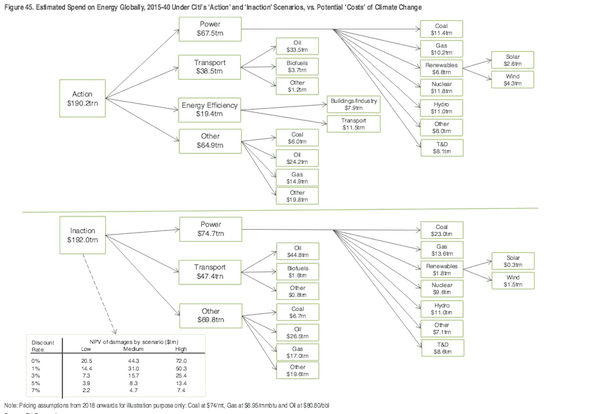

The report, which seeks to objectively analyse the economics of acting – or not – on climate change, finds that its ‘Action’ scenario – in which governments invest heavily in overhauling their energy markets, transport sectors and industries to a low-carbon mix – results in an undiscounted saving of $1.8 trillion out to 2040.

This is because, while governments spend more on renewables and energy efficiency in the early years (and yes, Citi does factor in the cost to existing industries of a massive shift to low-carbon energy sources), the savings in fuel costs in later years offset earlier investment, says the report.

Moreover, it adds, “if the scientists are correct,” – and strangely enough Citi believes they are – “the potential liabilities of not acting [listed further on in the report as global food shortages, widespread drought, mass population displacement, increased flooding, etc] are equally vast.”

“The cumulative ‘lost’ GDP from the impacts of climate change could be significant, with a central case of 0.7%-2.5% of GDP to 2060, equating to $44 trillion on an undiscounted basis,” the Citi report says.

The report finds that the cumulative losses to global GDP from climate change impacts (‘Inaction’) from 2015 to 2060 are estimated at $2 trillion to $72 trillion depending on the discount rate and scenario used. Lower discount rates encourage early action.

If emissions continue to rise and therefore temperature continues to increase after 2060, the negative effect on GDP losses could become more than 3% of GDP with estimates ranging from 1.5% to almost 5%.

More worryingly, the report notes that under an ‘Inaction’ scenario, the world would be locked to a high-emissions infrastructure and the damages could continue for more than a century, with the highest impacts of GDP foreseen in south and south-east Asia, Africa and the Middle East.

“The estimated damages could be larger as these economic studies only measure those impacts that are quantifiable and largely concentrate on market or near market sectors. Other impacts such as tipping points, weather related events or catastrophic risks are not included in the studies.”

One the other hand, says Citi, “if we derive a risk-adjusted return on the extra capital investment in following a low carbon path, and compare it to the avoided costs of climate change, we see returns at the low point of between 1% and 4%, rising to between 3% and 10% in later years.”

So, on a risk adjusted basis this implies a return of 1-4 per cent at the low point in 2021, rising to between 3-10 per cent by 2035, the report finds.

“Not spectacular returns,” Citi concedes, “but against current low yields… it represents a relatively attractive option.” And, of course, there is the added benefit of avoiding catastrophic global warming.

Summing up, the Citi report has this to say: “With a limited differential in the total bill of Action vs Inaction (in fact a saving on an undiscounted basis), potentially enormous liabilities avoided and the simple fact that cleaner air must be preferable to pollution, a very strong ‘Why would you not?’ argument regarding action on climate change begins to form.”

Can someone let Abbott know?