|

|

75 millionaires paying no tax

|

Inbox

|

x |

|

10:48 AM (1 hour ago)

|

|

|||

Dear NEVILLE,

At least 75 millionaires are paying less tax than you — in fact, they’re not paying any tax at all.

According to the Australian Tax Office, 75 Australians made more than $1 million in 2011-12 and paid zero tax — none.1 And they spent an average of $850,000 on aggressive tax avoidance, which they then got to claim as — you guessed it — a tax deduction!2

But thanks to the generous donations of GetUp members through our Brighter Budget campaign, our friends at The Australia Institute have developed a smart, sensible way to stop this rorting: “The Buffett Rule”.3

The Buffett Rule says: Right, enough of all of this loophole rubbish, the wealthiest 1% of income earners have to pay at least 35% in income tax — based around the rate paid by many Australian workers.4 This new tax Rule could raise nearly $2.5 billion per year – more than the Abbott Government’s cuts to Newstart benefits and the age pension combined.5

Both the Government and Labor Opposition are finally talking about revenue measures for the Budget, and are looking for what works and what’s popular. Together, we can deliver them the Buffett Rule on a silver platter by backing it and sharing it with our friends.

The Buffett Rule was inspired by multi-billionaire U.S. investor Warren Buffett. After Mr Buffett pointed out the gross unfairness of his secretary paying more tax than he did, President Obama proposed the Buffett Rule to ensure the wealthiest Americans paid at least the same tax rate as middle income earners.

The Buffett Rule became hugely popular, with the Wall Street Journal even reporting that 68% of millionaires supported a Buffett Rule in some form.6 So even those benefiting from these tax loopholes can’t help but support it!

GetUp’s member-funded Brighter Budget campaign aims to build a better future through smarter, fairer Budget policies. Through this first policy report, we’re bringing the Buffett Rule to Australia and applying it to high income tax dodging. This includes people who make millions and then reduce their taxable income down to an averge of $1.09 per year.7

GetUp members are funding research right now showing that this idea could be hugely popular in Australia too, especially in the key marginal electorates that will determine the outcome of the next election. But with the report launching today, now’s the time to get immediate public support behind it to grab the attention of our leaders. Click below to sign the petition:

https://www.getup.org.au/buffett-rule

Big corporations are rightly under the microscope for their tax avoidance measures right now – something GetUp members have been campaigning to achieve. But we can’t let millionaire tax dodgers get off scot-free either.

The principle is the same: everyone should pay their fair share to support the benefits we all get by living, working or running a business in Australia. Click here to join the fight.

Thanks for all you do,

Mark, Evan, Georgina and Nat for the GetUp team

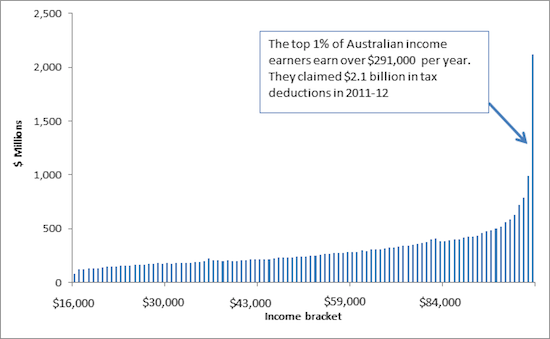

PS – The graph below shows how the use of tax deductions skyrockets for the very highest income earners. One simple rule – The Buffett Rule – would change all that. Sign the petition today and share it with your friends.

Source: “Closing the tax loopholes: A Buffett rule for Australia”, The Australia Institute, 7 April 2008

References:

1. “Closing the tax loopholes: A Buffett rule for Australia”, The Australia Institute, 7 April 2008

2. Same as above.

3. “‘Buffett Rule’ proposed to make sure high earners pay some tax”, The Sydney Morning Herald, 8 April 2008.

4. “Closing the tax loopholes: A Buffett rule for Australia”, The Australia Institute, 7 April 2008

5. “Changed indexation of pensions and tightened eligibility for all benefits”, Budget Review 2014-15, Parliament of Australia

“Federal budget 2014: Young to wait until 25 to get dole”, The Sydney Morning Herald, 14 May 2014

6. “Millionaires Support Warren Buffett’s Tax on the Rich”, The Wall Street Journal, 27 October 2011

7. “Closing the tax loopholes: A Buffett rule for Australia”, The Australia Institute, 7 April 2008